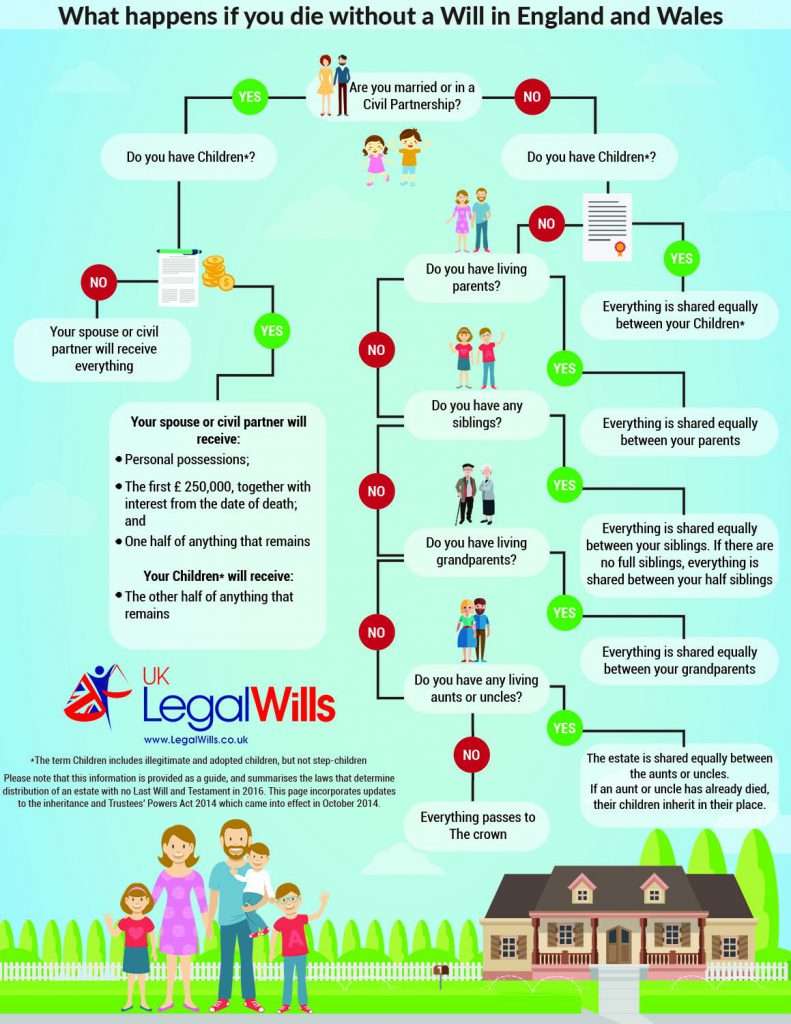

wills

Featured Articles

How to write a Will – the service at ExpatLegalWills.com

Most people know that they need a Will, but with 65% of adults in Canada, the UK and the US without a Will, there is clearly a barrier to getting...

Continue reading